Return of Allotment of Shares

Shares allotted Please give details of the shares allotted Class of shares. From now on easily cope with it from home or at the office straight.

Pas 3 Form Return Of Allotment Learn By Quickolearn By Quicko

NAMES ADDRESS AND PARTICULARS OF ALLOTMENT Names Address No.

. Amount paid or due and payable on each share. Making changes to the RBO if necessary. Know all how the procedure and requirements.

Issue new shares in the company after it has been registered. Private companies can allot new shares only after filling the Return of Allotment of Shares. RETURN OF ALLOTMENT OF SHARES.

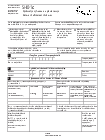

It is a statement that includes the details of the shareholders and the allocated shares which are subjected to submission to the Registrar with. FORM 24 Companies Act 1965 Section 541 Company No. Fast Easy Secure.

Issue of New Share Certificates. Final Date of filing Form PAS-3. A Return of Allotment also known as the SH01 form must be completed if you decide to allot ie.

Such allotment of new shares increases the companys share capital. While public companies are free to allot new shares anytime but they also have to fill the. Yes all Return of Allotment of Shares ROA occurring after 31 January 2017 must be lodged online MyCoID 2016.

Upload Edit Sign PDF Documents Online. An allotment of shares is when a company issues new shares in exchange for cash or otherwise. Edit PDF Files on the Go.

SH01 return of allotment of shares. I Issuance of shares to the general public in this case the firm should file a return of allotment of shares with the Registrar within 30 days. RETURN OF ALLOTMENT OF SHARES Under section 611 a of the Act.

This form can be used to give notice of shares allotted following incorporation. PDF 674 KB 10 pages. 3 If the allotment is made for shares fully paid or partly paid.

In the case of the first return shares subscribed for in the Memorandum are to be included in this return and identified as such. Updating the register of members and other registers as required. Shares were allotted over a period of time complete To Date d d m m y y y y both from date and to date boxes.

Get Started for Free. Allotment of Shares under the companies act 2013 is basically the distribution of shares to existing shareholders or new shareholders. What is return of allotment.

Filling out Return Of Allotment Of Shares - Bizfile - Bizfile Gov does not really have to be complicated any longer. Ad Professional-grade PDF editing. If the company has period for the date of allotment what is the date.

Informing the CRO on the next annual. Allotment Dates Allotment date If all shares were allotted on the From Date same day enter that date in the from date box. If shares were allotted over a period of time complete To Date.

RETURN OF ALLOTMENT OF SHARES Number of shares allotted payable in cash. Number of shares allotted for consideration other.

Form 24 Return Of Allotment Of Shares Pdf

No comments for "Return of Allotment of Shares"

Post a Comment